Effects of the Great Depression

The Balance / Julie Bang

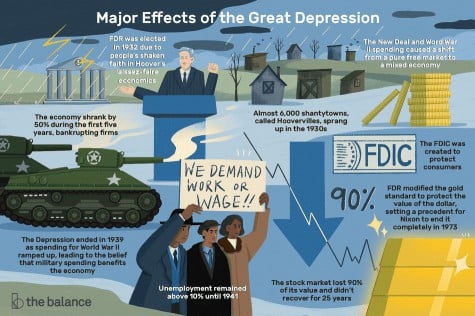

The Great Depression of 1929 devastated the U.S. economy. A third of all banks failed. Unemployment rose to 25%, and homelessness increased. Housing prices plummeted, international trade collapsed, and deflation soared. It took 25 years for the stock market to recover.

While the Great Depression took a huge toll on the U.S., there were a few good things that came from it. For example, the New Deal programs installed safeguards to make it less likely that the Depression could happen again.

Overall, the Great Depression had a tremendous impact on nine principal areas of the U.S. economy, which are outlined below.

Economy and Gross Domestic Product (GDP)

During the first five years of the depression, the economy shrank by 50%. In 1929, economic output was $105 billion, as measured by gross domestic product (GDP). That's equivalent to more than $1 trillion today.

The economy began shrinking in August 1929. By the end of the year, one-third of all banks had failed. In 1930, the economy shrank by another 8.5%, according to the Bureau of Economic Analysis (BEA). GDP growth declined 6.4% in 1931 and 12.9% in 1932. By 1933, the country had suffered at least four years of economic contraction. It only produced $57.2 billion, half what it produced in 1929.

Part of the contraction was due to deflation. According to the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI), which is used as a measure of inflation, fell by 25% between 1929 and 1933. Falling prices sent many firms into bankruptcy.

Note

The BLS reported that the unemployment rate peaked at 24.9% in 1933.

New Deal spending boosted GDP growth by 10.8% in 1934. It grew by another 8.9% in 1935, 12.9% in 1936, and 5.1% in 1937.

Unfortunately, the government cut back on New Deal spending and the depression returned, causing the economy to shrink by 3.3% and the unemployment rate to jump to 19% in 1938.

Preparations for World War II sent growth up by 8% in 1939 and by 8.8% in 1940. The next year, Japan bombed Pearl Harbor, and the United States entered World War II. Annual GDP growth jumped to 17.7%.

The New Deal and spending for World War II shifted the economy from a pure free market to a mixed economy. It depended much more on government spending for its success. The timeline of the Great Depression shows this was a gradual—though necessary—process.

Politics

The Depression affected politics by shaking confidence in unfettered capitalism. That type of laissez-faire economics is what President Herbert Hoover advocated, and it had failed.

As a result, people voted for President Franklin D. Roosevelt (FDR). His Keynesian economics promised that government spending would end the Depression. The New Deal worked. In 1934, the economy grew, and unemployment declined.

But FDR became concerned about adding to the U.S. debt. In 1933, the national debt was $22.5 billion, and by 1934, it was $27 billion. He cut back government spending by 1938, and the Depression resumed.

No one wants to make that mistake again. Politicians now tend to rely instead on deficit spending, tax cuts, and other forms of expansionary fiscal policy. Because of that, the U.S. national debt has increased to a very high level.

The Depression ended as government spending ramped up for World War II at the end of the 1930s and early 1940s. This change in spending led to the belief that military spending is good for the economy. However, since then, the government and economists have found that military spending is not a top way to create jobs.

Social

The Dust Bowl drought destroyed farming in the Midwest. It lasted 10 years—too long for most farmers to hold out. To make things worse, prices for agricultural products dropped to severely low levels. As farmers left in search of work, they became homeless. Thousands of people with no money gathered in "cardboard shacks" called Hoovervilles.

In 1933, Prohibition was repealed. That allowed the government to collect taxes on sales of now-legal alcohol. FDR used the money to help pay for the New Deal.

The Depression was so severe and lasted so long that many people thought it was the end of the American Dream (the idea of guaranteed rights to pursue one's own vision of happiness). Instead, it changed that dream to include a right to material benefits.

Unemployment

In 1928, the final year of the Roaring Twenties, unemployment was 4.2%. That's less than the natural rate of unemployment. By 1930, it had more than doubled to 8.7%. By 1932, it had increased to 23.6%. It peaked in 1933, reaching up to around 25%. Almost 15 million people were out of work. That's the highest unemployment rate ever recorded in America.

New Deal programs helped reduce unemployment to 21.7% in 1934, 20.1% in 1935, 16.9% in 1936, and 14.3% in 1937. But less robust government spending in 1938 sent unemployment back up to 19%. It remained above 10% until 1941, as you can see when looking at the unemployment rate by year.

Banking

During the Depression, a third of the nation's banks failed. By 1933, 4,000 banks had failed. As a result, depositors lost $140 billion.

People were stunned to find out that banks had used their deposits to invest in the stock market. They rushed to take their money out before it was too late. These “runs” forced even good banks out of business. Fortunately, that rarely happens anymore.

Note

Depositors are protected by the Federal Deposit Insurance Corporation (FDIC). FDR created that program during the New Deal.

Stock Market

The stock market lost 90% of its value between 1929 and 1932. It didn't recover for 25 years. People lost all confidence in Wall Street markets. Businesses, banks, and individual investors were wiped out. Even people who hadn't invested lost money. Their banks invested the money from their savings accounts.

Trade

As countries' economies worsened, they erected trade barriers to protect local industries. In 1930, Congress passed the Smoot-Hawley tariffs, hoping to protect U.S. jobs.

Other countries retaliated. That created trading blocs based on national alliances and trade currencies. World trade plummeted by 66% (as measured in dollars) between 1929 and 1934. By 1939, it was still below its level in 1929.

Imports from Europe declined greatly between 1929 and 1932, dropping to $390 million from $1.3 billion at the start of the Depression. Exports to Europe also declined to $784 million from $2.3 billion during that same time.

Deflation

Prices fell by 30% between 1930 and 1932. Deflation helped consumers whose income had fallen, but it hurt farmers, businesses, and homeowners because mortgage payments hadn't fallen by 30%. As a result, many defaulted on home loans. Homeowners lost everything and became migrants looking for work wherever they could find it.

Below you can see the CPI per year as an annual percent change:

- 1929: 0.0%

- 1930: -2.7%

- 1931: -8.9%

- 1932: -10.3%

- 1933: -5.2%

- 1934: 3.5%

- 1935: 2.6%

- 1936: 1.0%

- 1937: 3.7%

- 1938: -2.0%

- 1939: 1.3%

- 1940: 0.7%

- 1941: 5.1%

Long-Term Impact

The success of the New Deal made many Americans expect that the government would save them from any economic crises. During the Great Depression, people relied on themselves and each other to pull through. The New Deal signaled that they could rely on the federal government instead.

FDR modified the gold standard to protect the dollar's value. That set a precedent for President Richard Nixon to end it completely in 1973.

The New Deal Public Works Administration (PWA) built many of today's landmarks. Iconic buildings include the Chrysler Building, Rockefeller Center, and Dealey Plaza in Dallas. Bridges include San Francisco's Golden Gate Bridge, New York's Triborough Bridge, and the Florida Keys' Overseas Highway. Other Depression-era public works include La Guardia Airport, the Lincoln Tunnel, and Hoover Dam. Also, three entire towns were constructed: Greendale, Wisconsin; Greenhills, Ohio; and Greenbelt, Maryland.

Frequently Asked Questions (FAQs)

Whom did the Great Depression affect?

Nearly everyone was affected by the Great Depression, but they weren't all impacted to the same degree. Many people lost their job, but even those who didn't experienced some negative effects from the reduced levels of investment and economic growth. For example, if a neighborhood bank failed, then it became harder to take out a mortgage or small business loan. The effects were felt globally, as well, and many countries experienced similar economic declines.

What were the immediate effects of the Great Depression?

The stock market crash in 1929 was swift and severe. It rippled throughout the financial community, and banks started to fail. That slowed economic growth, reduced business activity, and increased the unemployment rate. As the effects rippled, it took longer to gauge the full impact of the Great Depression. For example, it took four years for the unemployment rate to peak.